RTRONS (R-LOS) automate your loan application process across from multiple channels to make informed decisions about loan approval / rejection at the initial stage. using RTRONS (R-LOS) a lender would conduct a credit appraisal mainly to make ascertain that the bank gets their money back from the loan customers. 7+ Co-Operative banks reviewed Our R-LOS. R-LOS has comprehensive features as it appraises or evaluates management, market, technical, & financial elements before sanctioning loans.

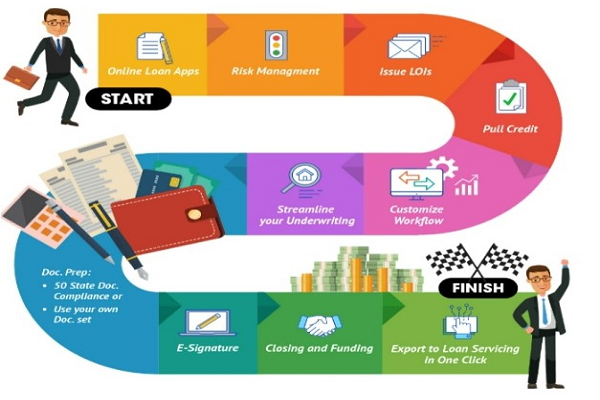

Loan origination software enables financial institutions to automate and manage the workflow of different steps of the lending process. The steps in the process include loan application, underwriting, credit approval, documentation, pricing, funding, and disbursement or the rejection of the application. It integrates with other front-end and back-end applications of lenders to exchange data and communications for delivering a seamless digital lending experience. Furthermore, it adheres to industry compliance and regulation standards to eliminate security breaches and protect customer data. The software is typically used by financial institutions to manage activities related to consumer, commercial, retail, SME, SBA in one centralized place.

A loan origination system (R-LOS) is technology that helps financial institutions generate loan documentation in a way that complies with regulatory and internal requirements. Banks and credit unions usually install loan origination software on their local servers or access it through a cloud-based platform. Each day, banks and credit unions of all sizes across the United States utilize loan origination software to reduce risk and streamline lending.

Before loan origination systems became common in banking, loan departments typically relied on legal form templates to manually generate promissory notes, deeds of trusts, and other documents for customers or members. This approach was time-consuming and prone to errors, especially for banks and credit unions that have many account holders, branches, and loans.

RTRONS R-LOS Loan origination systems help banks and credit unions overcome the challenges of manual document creation, delivering numerous potential benefits to the institution:

Compliance: Reduced risk of compliance issues caused by missing or errant information in documents.

Productivity: Increased efficiency through a streamlined approach to document generation.

Collectability: Preventing oversights in documents helps banks and credit unions ensure collectability during foreclosures.

Some banks and credit unions use their R-LOS primarily for document preparation, while others use it from application through closing. Prior to use, however, financial institutions should ensure the LOS is configured to their specific needs. For example, a bank or credit union may determine that certain default clauses need to be adjusted prior to use. Consulting with the institution’s legal counsel is an important step to ensure proper LOS setup.

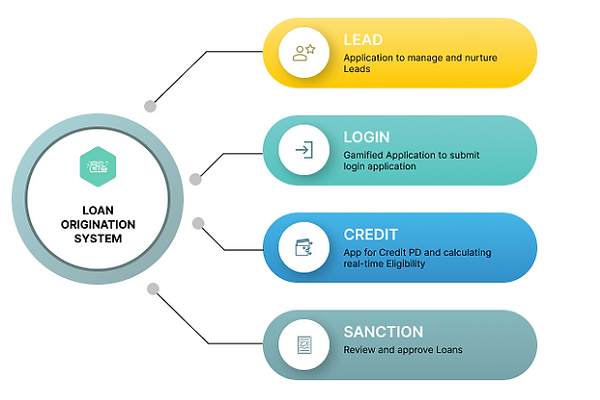

Once configured, general use of an R-LOS follows this basic work flow:

Generating documents through an R-LOS is not the end of the story. Documents must be retained in accordance with the bank or credit union’s retention policy and other regulatory requirements. Some financial institutions choose to store most or all their documents in hard copy format, which can consume large amounts of physical space. Other banks and credit unions integrate their LOS to an electronic document management system, which can yield additional efficiencies.

RTRONS SOFTWARES (R-LOS) Automate Your Loan Application Process Across Multiple Channels To Make Informed Decisions About Loan Approval / Rejection At The Initial Stage Itself. No Wear & Tear As Against Physical Files, All Data Is Stored In Server With Easy Retrieval. RTRONS (R-LOS) Provide Faster Enquiry Model Helps For Follow-Up And It Helps To Monitor Market Trend And Convert Business In Rapid Force. RTRONS (R-LOS) Makes Daunting & Tedious Economic Analysis Quick, Accurate, And Approachable. Offer Solutions That Could Help In Being More Agile, Consistent, & Precise In High-Volume Decision-Making Processes. 24x7 Support System Available For Any Software Related Solution / Issue.

Download BrochureNo physical movement of records made across various desks, as all data stored online with easy retrieval. Provide a faster enquiry model which helps in enquiry follow-up & shortlisting potential clients.

Core Values are essential and enduring principles of RTRONS SOFTWARES that are integral to our success to date. These core values are unaffected by the trends of the day or market conditions.

Uniting all of RTRONS SOFTWARES activities is its value system. A strict code of ethics, an unstinting commitment to customers and employees, and a clearly defined management philosophy form the core of the organization

To strive to be the preferred pathway for technology. Our products business activities will be characterized by the high quality, innovation, dedication, competitive awareness, ethical business practices and outstanding service.